Just wanted to share something that applies to any type of car loan, home loan, new credit application.

Many of you prefer to remain debt free and/or payoff your credit cards monthly like I do but in the event you plan to make a large purchase or as applies to this forum, buy a new truck, you can bump your FICO score up a bit with a little planning ahead.

This mainly applies to you if you carry zero balance due across ALL of your credit cards. FICO views zero debt or "utilization" as a negative and a small amount of debt or utilization as a positive and then a big negative again when your utilization or debt is too high.

If you carry zero debt regularly, make a purchase with your credit card but DO NOT pay it off right away, wait until the next statement date for that credit card so that the small purchase you made is reported to the 3 major Credit Reporting Agencies, ie Transunion, Equifax, Experian. If you always pay off your credit card before the statement date, no utilization is ever shown to the CRA's. Once the balance due on your statement is reported to the CRA's you then have 25-30 days before the next statement to pay it off as your normally would with zero interest charges incurred.

1% utilization is the best possible for maximizing FICO scores.

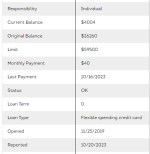

As seen below in my example, (truck delivers May 7th-ish but I'll secure my loan probably just before May 1st) I made a purchase of $24.37 on a credit card with a 44,500 credit limit resulting in 0.52% debt utilization (FICO rounds up to 1 full percentage point) resulting in a nice bump. Lenders don't care if your score is 800 or 850, its the same either way, good is good, no extra credit given (pun intended) but if you are borderline next lower tier credit this little trick could put you over the top.

Many of you prefer to remain debt free and/or payoff your credit cards monthly like I do but in the event you plan to make a large purchase or as applies to this forum, buy a new truck, you can bump your FICO score up a bit with a little planning ahead.

This mainly applies to you if you carry zero balance due across ALL of your credit cards. FICO views zero debt or "utilization" as a negative and a small amount of debt or utilization as a positive and then a big negative again when your utilization or debt is too high.

If you carry zero debt regularly, make a purchase with your credit card but DO NOT pay it off right away, wait until the next statement date for that credit card so that the small purchase you made is reported to the 3 major Credit Reporting Agencies, ie Transunion, Equifax, Experian. If you always pay off your credit card before the statement date, no utilization is ever shown to the CRA's. Once the balance due on your statement is reported to the CRA's you then have 25-30 days before the next statement to pay it off as your normally would with zero interest charges incurred.

1% utilization is the best possible for maximizing FICO scores.

As seen below in my example, (truck delivers May 7th-ish but I'll secure my loan probably just before May 1st) I made a purchase of $24.37 on a credit card with a 44,500 credit limit resulting in 0.52% debt utilization (FICO rounds up to 1 full percentage point) resulting in a nice bump. Lenders don't care if your score is 800 or 850, its the same either way, good is good, no extra credit given (pun intended) but if you are borderline next lower tier credit this little trick could put you over the top.